As Seen On

【16 Minutes Video】

[18 Minutes Video]

Unlock Financial Freedom with 3 Simply Ways

Unlock Financial Freedom with 3 Simple Ways

Recycle Money Formula

Recycle Money Formula

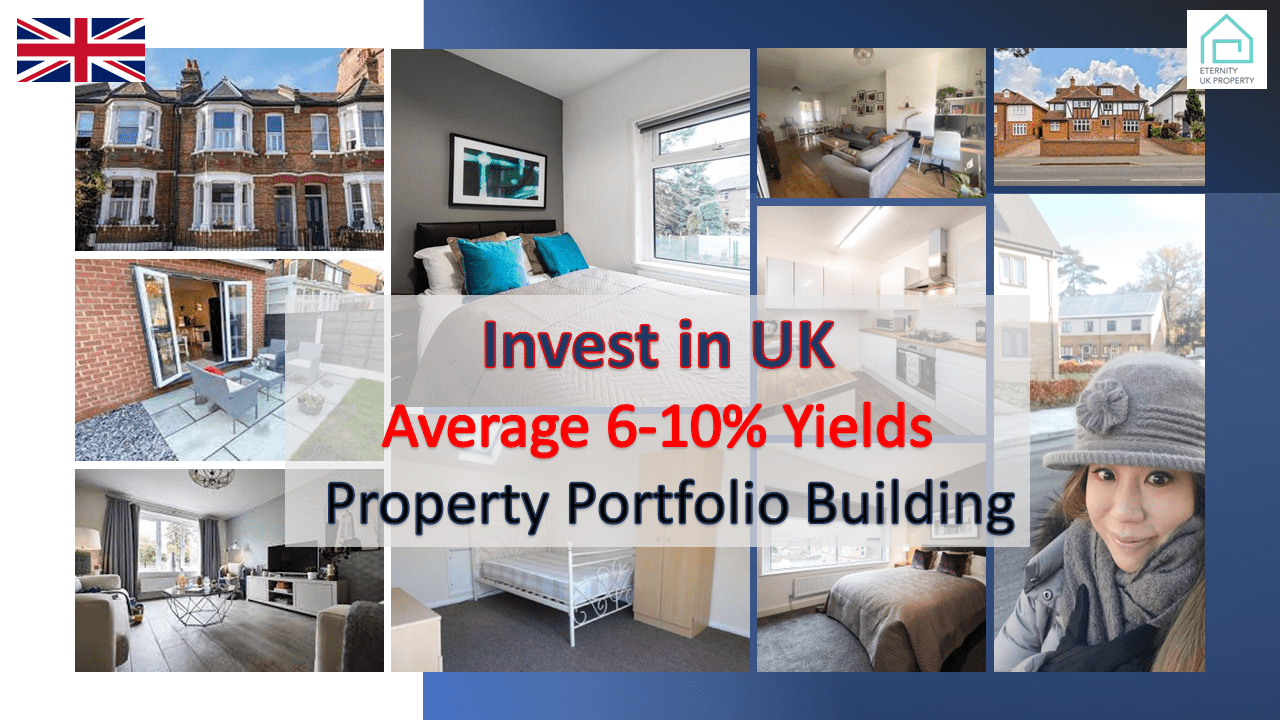

Accumulating UK Property Over SG

Accumulating UK Property Over SG

Start Building Your Monthly Positive Cashflow

Start Building Your

Monthly Positive Cashflow

Maximizing Your Wealth: The Smart Investment Strategy

Recycle Money Formula

Recycle Money Formula

Building a Property Portfolio in UK than Other Countries

Avery Chan

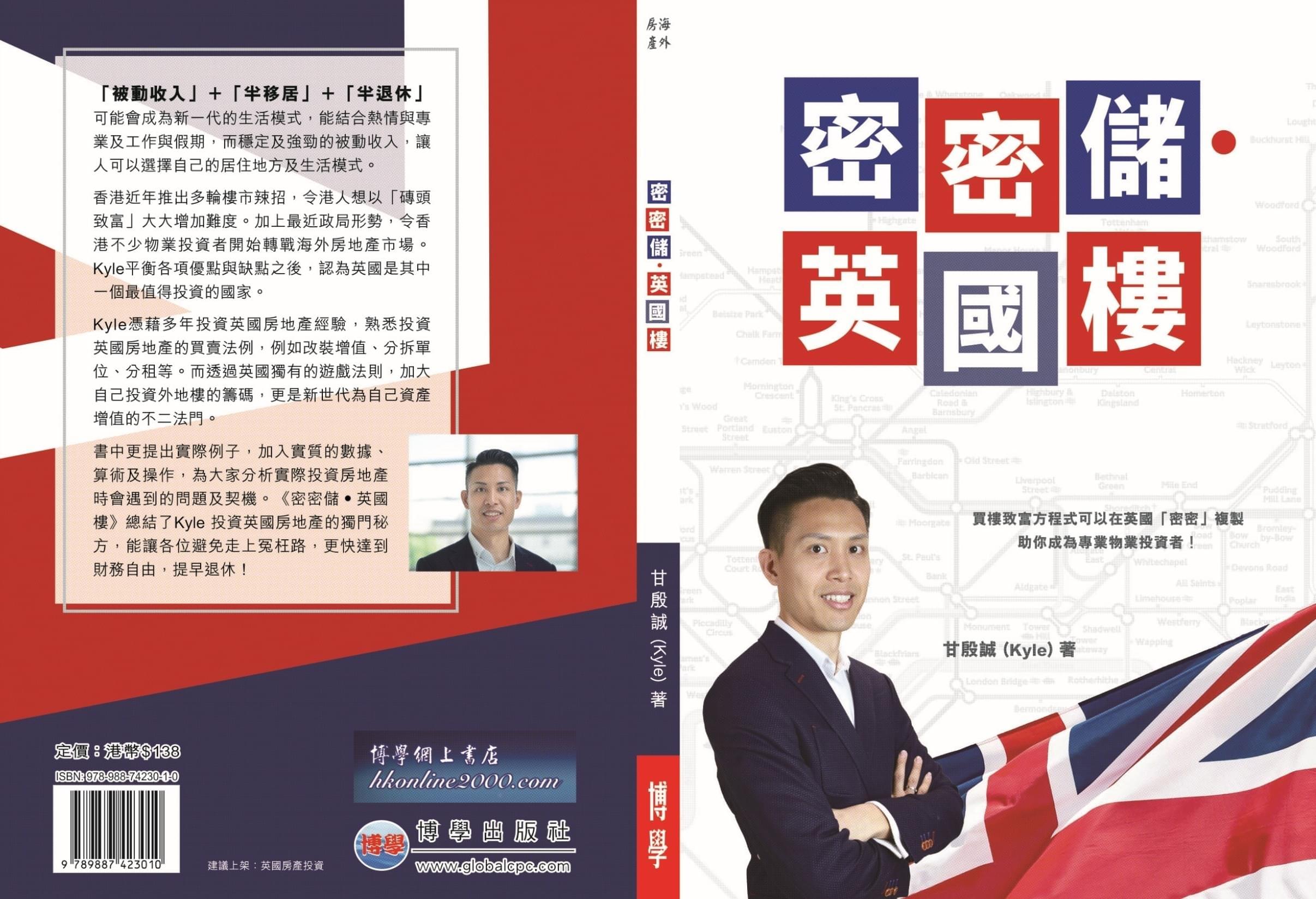

To obtain financial freedom, one must be either a business owner, an investor, or both, generating passive income, particularly on a monthly basis- Robert Kiyosaki

She enrolled in a financial education course taught by Robert Kiyosaki, the author of Rich Dad Poor Dad, in few years ago.

Even though she held a well-paying position as a Senior Manager at a publicly traded company, she decided to resign after achieving substantial growth in the property business, generating five-figure passive income monthly, and skillfully overseeing a property portfolio worth millions of pounds.

After establishing a methodical property investment business, complete with effective strategies and financing options, she now enjoys the flexibility to reside anywhere and dedicate more time to her loved ones. With her assets constantly generating passive income, she no longer frets over expenses such as medical bills or education expenses for her children.

She founded UK Property Box & Eternity UK Property, which offers comprehensive services to global buyers seeking to invest in the UK. The company has facilitated over 500 clients in purchasing more than 1,000 UK properties. Their specialty lies in aiding international investors in navigating the challenges of remotely managing a foreign buy-to-let investment property.

Eternity UK Property

Dedicated Support International Buyers to Invest Pre-owned Properties in UK

I've purchased a property under market value 32% and remortgage after renovation. The solicitor and mortgage advisor provide professional service and fast response.

Highly recommend their services!

- Eric Lim - Doctor

Thanks Eternity helped me to take a big step on my financial freedom, I can really implement the strategies. I can apply for a UK bank mortgage and now is waiting for the completion for the second and third freehold properties in the UK.

- Timothy Chong - Lawyer

Eternity is a service oriented. Follow up is top notch. Resolution and replies to concerns are immediate. There maybe a fee to pay but it takes out the hassle and all worth it in the end! All the best to Eternity and yes, I would definitely use their services.

- Alex Ong - Accountant

I'd like to share some thoughts over the 1-on-1 personal consultation, as a new investor in the UK property market, I can tell you guys are good listeners and your advice is very informative and I appreciated your top down approach and the analysis of risk.

- Michelle Tan - Business Owner

Frequently Asked Questions

How Much Does a UK Property Cost?

UK property is much cheaper than Singapore in most cases.

According to this survey, the average price per square metre of a property in London is around GBP £12,800 (around 24,000 Singapore Dollars) per square metre compared to GBP £14,557 (27,400 SGD) in Singapore. Outside London however, you can buy property for GBP £3,000-£4,000 (5,500-7,500 SGD) per square metre or less – meaning UK property can be around 25% of the price of Singapore.

It’s a good idea to start by taking your budget in Singapore Dollars and converting it into GBP using a currency converter. This will give you an approximate idea of what you can buy in the UK.

What Types of Property can Singaporeans Buy in the UK?

You can buy any type of privately owned property in the UK. There aren’t any restrictions on types and areas open to foreign buyers.

The UK market offers a wide range of different property types including landed houses and flats or apartments in blocks – the term condominium isn’t used in the UK. Landed properties come as detached houses, semi-detached houses and terraced houses. Since the UK has much more space than Singapore there are more houses than flats in most places.

Can Singapore Residents to Apply UK Bank Mortgages?

Yes, you can. It may be possible to get a UK bank mortgage as it is known if you live in Singapore, although there are fewer lenders who offer international mortgages.

How about Stamp Duty in the UK?

Stamp Duty or Stamp Duty Land Tax (SDLT) is a tax payable by buyers of UK property. It is a similar concept to Buyer’s Stamp Duty (BSD) in Singapore. Stamp Duty is payable as a percentage of the actual sale price but it varies according to the value of the property and the status of the buyer.

More information about Stamp Duty can be found, please watch Free Video.

If you are not a UK resident you will have to pay a non-resident rate of SDLT which is 2% in addition to the normal rate. These additional rates are similar in concept to Additional Buyer’s Stamp Duty or ABSD in Singapore.

Buy-to-let property: Limited Company VS Personal Name?

Using a limited company can often be the most cost-efficient way to invest in property and minimize your personal liability. The correct company structure will serve to maximize your profits and free-up the time you need to focus on growing your business.

You can deduct certain expenses when you own through a limited company. Rental profits on properties held in a limited company are not taxed according to personal Income Tax rates. Instead, they’re charged Corporation Tax which stands at 19%.

If you are like our professional investor and like to reinvest profits to create bigger profits, the compounding effect of only paying tax over time is huge. This should snowball into big numbers if consistently reinvested over many years.

When owned personally, any property income would be taxed in its entirety every tax year. This provides you with no ability to defer.

If I Own Property in Other Country, Could Affect My Status of Owning Property in Singapore?

If you own property in Ltd Company, the legal status is company. So when you search on the Land Registry, the company’s name will appear as the owner rather that the individual’s.

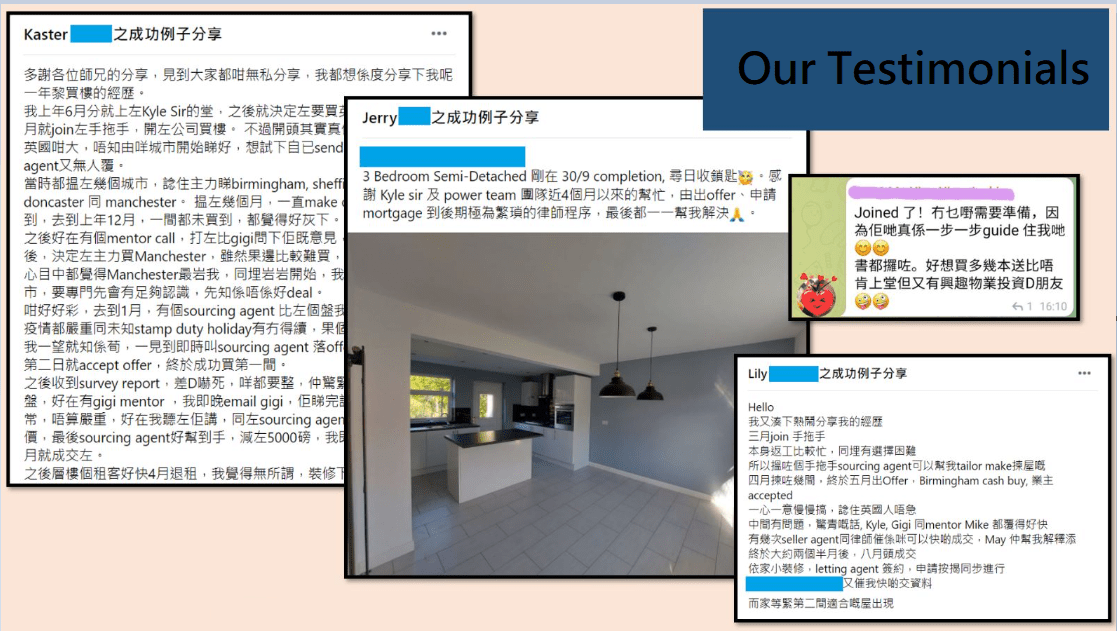

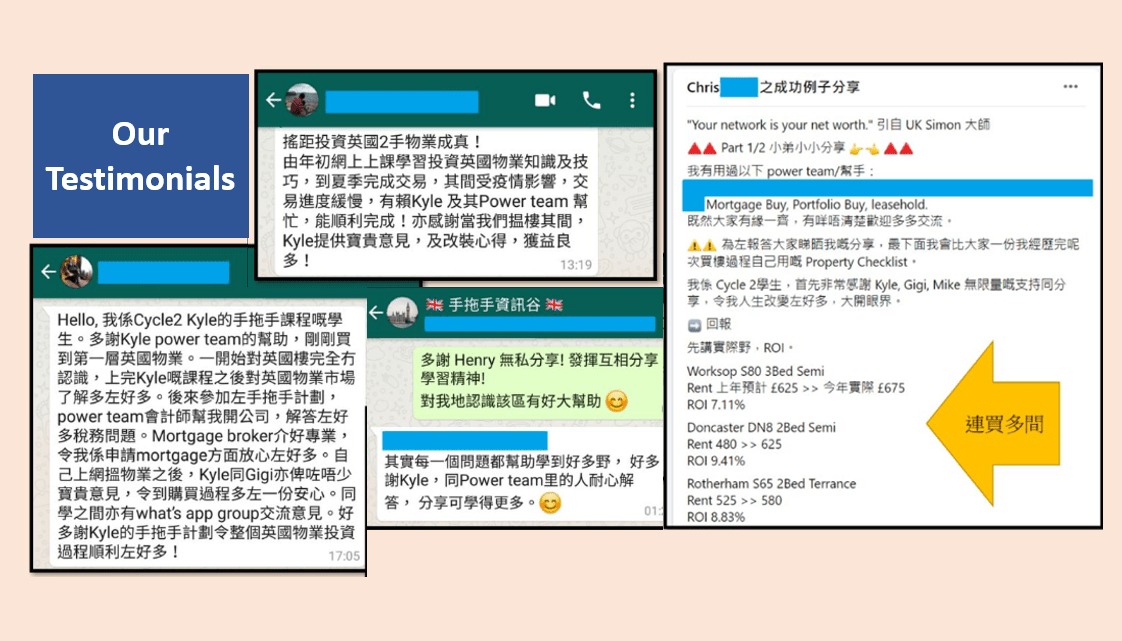

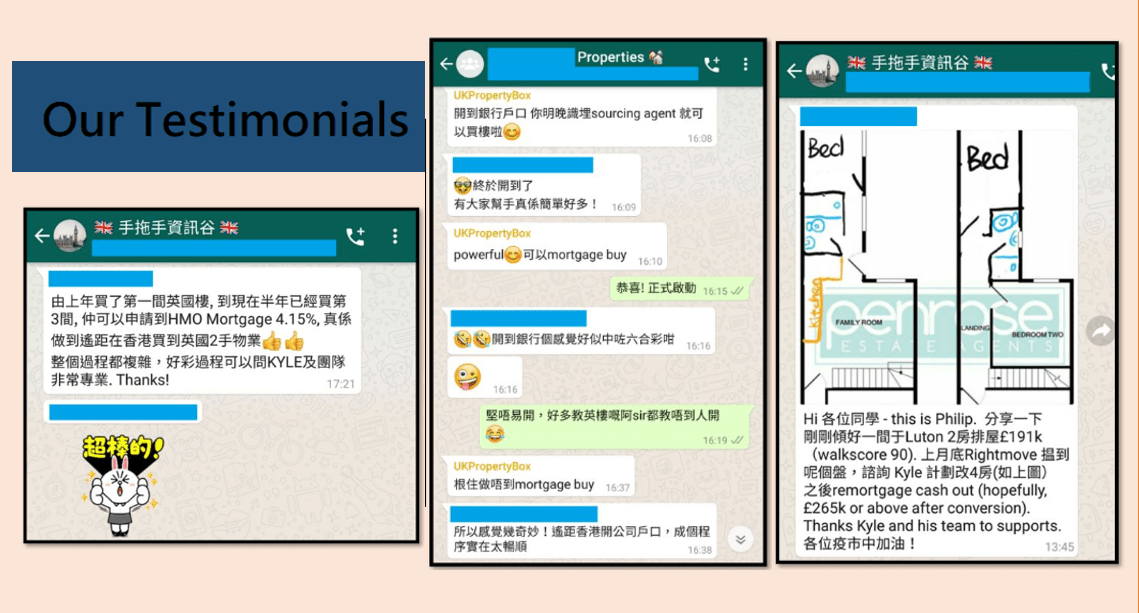

Will You Be The Next One?

Start Your UK Property Investment Now!

Create Positive Passive Income